Wealth

By Ayoob Rawat & Kabir Rawat

HISTORY OF WEALTH

‘Wealth’ originates from old English ‘weal’, which means ‘wealth, welfare, and well-being. To a certain extent, the accumulation of net resources (net asset value) did not mean abundance which is better defined by the term ‘rich'.

In the book ‘An Inquiry into the Nature and Causes of the Wealth of Nations, Adam Smith (1776) explains that wealth was mostly related to a community or a nation that had accumulated and was able to produce more resources than say a poor one.

Over time, individuals, the first entrepreneurs, started accumulating wealth for their own private accounts. The nature and mindset of these individuals were focused on the creation or acquisition of wealth, be it for the good of all or simply for their own. However, this also led to the accumulation of wealth well beyond their immediate and future needs.

At the dawn of human civilisation, the plantation of crops for food was much less life-threatening than competing with dangerous animals to hunt. This must have been planned as they would have had to continue hunting as crops do not grow overnight.

Therefore, wealth was mostly related to the food security of the human race. While it takes time to grow crops, once grown, the person, his family and the community could be fed on an ongoing basis if only he could protect them. This led to the basic common-sense principle of Financial Advice, ‘One reaps what one sows.’

Even though farming requires care and patience, the returns could feed the farmer, his family and the community on an ongoing basis. This is significantly better than hunting an animal and being able to feed himself and maybe his family for only a few days at most.

Over the years, different designations have been used to describe individuals giving Financial Advice leading to Investment Advice followed by Wealth Management. The term ‘Wealth Management’ itself was institutionalised by major American banks in the ’30s during a process of client segmentation to provide selected services to high net worth clients.

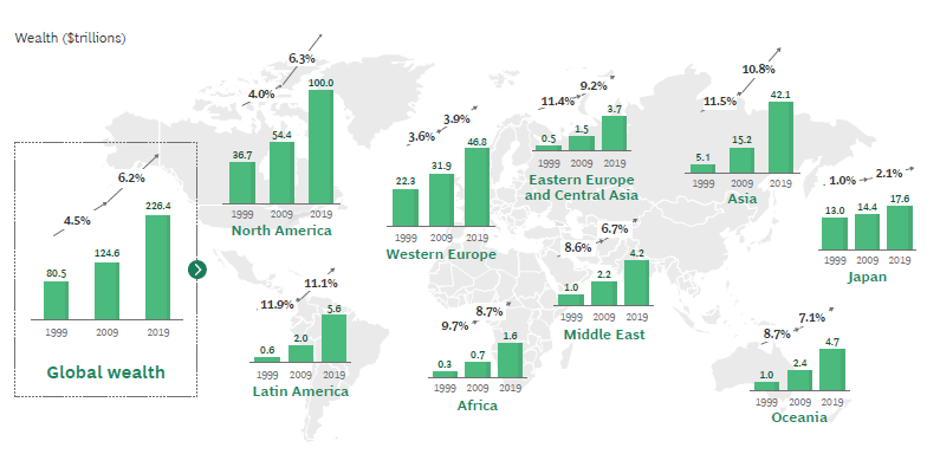

WEALTH DEVELOPMENT OVER THE LAST 20 YEARS

Source: Global Wealth Report 2020—BCG Global Wealth Market Sizing Database.

WEALTH SERVICES

The world economy, comprising 194 economies, in 2021 is projected around US$93.86 trillion in nominal terms, according to the IMF.

Wealth Services is a broad sector that includes a range of services that caters for most of the economy.

These services include amongst others:

➡️ Financial Services

➡️ Wealth Management

➡️ Private Wealth

➡️ Family Office Services

➡️ Personal Finance

➡️ Financial Literacy

➡️ Entrepreneurship

➡️ Lifestyle services

Its focus is on private wealth as opposed to institutional or business wealth.

All of this wealth is being taken care of by Wealth Services.

WEALTH SERVICES V/S WEALTH MANAGEMENT

It's interesting how when people hear the term 'Wealth Services' it is automatically assumed to mean 'Wealth Management' and that these services are linked with ‘MONEY ONLY’

'Wealth Management' is a 'Wealth Service' and we will be talking about Wealth Management a bit more below.

But ‘Wealth Management’ (a bit like financial planning) has become synonymous with ‘financial and investment advice'.

Whereas 'Wealth Services' can be either advisory and/or non-advisory.

➡️ "Why does that affect me?" you may ask!

Well, maybe your pre-conceived thoughts of 'Wealth Management' has stopped you from investigating a career in 'Wealth Services'

P.S. I challenge you to type 'Wealth Services' into Google and find a standard definition of it.

➡️ Why will Wealth Services (as opposed to Wealth Management) become more and more relevant and critical to professionals?

Most people in the emerging economies (and perhaps beyond) do not need experts to advise them on how to invest wealth.

➡️ Why?

Because most people in the emerging economies (and perhaps beyond) quite simply do not have investable wealth.

Let us look at Switzerland as an example. Switzerland as I am sure you are aware is now one of the world’s wealthiest nations.

It has a very strong stable currency and economy that attracts Private Wealth into some of the best private banks in the world.

Hence the Swiss provide world-class 'Wealth Management' solutions.

This was not always the case!

As a landlocked, mountainous country with no natural resources, the inhabitants have known severe poverty.

Believe it or not, the Swiss was once an emerging economy.

As an emerging economy 'Wealth Management' would have probably only been required by the royalty and perhaps the nobility.

The majority of people would have required other services such as basic financial services, personal finance skills, business development skills, accessing finance, financial strategy, sales & marketing, branding, etc.

It is actually a good time to enlarge the scope of wealth management and offer wealth services to clients of all backgrounds, wealth statuses and ages. Of course, each client will be serviced by what they need.

So to summarise, Wealth Services is a broad sector where professionals advise and consult on topics such as:

- What is wealth!

- How to create wealth.

- How to develop business.

- How to start a business.

- How to create jobs.

- How to build wealth.

- What is private wealth?

- Should we be investing? (Which would also be considered to be wealth management)

- How to protect wealth.

- How to adapt to a lifestyle that fits wealth, etc.…

WEALTH MANAGEMENT

Wealth Management is simply managing other people’s wealth. Wealth is owned by what the industry has termed as High Net Worth Individuals (HNWI), and whilst recent measures have been based on net investable assets of $1M, different banks and countries apply their own measures which may be higher or lower.

‘Managing’ wealth is more complex than it may sound because it is not simply a case of placing cash on deposits or buying some shares or bonds, but rather it involves dealing with complex issues that rich people have, like; handling different classes of assets, structures, tax and estate planning, lifetime cash flow, insurances and non-investable assets.

Wealthy individuals have varied and complex needs that can hardly be dealt with by one individual alone. Normally, there is one trusted advisor who has a holistic overview of the client’s needs: dealing with what the trusted advisor’s core competency can handle and bringing in the expertise required either from within the organisation or, without hesitation, from the outside as and when needed.

Wealth Management as an industry is becoming specialised and can be compartmentalised as follows:

- Custodian – where assets and data and related information are safeguarded.

- Investment Manager – who can make specific investment recommendations, this can be further split into:

- Cash or money market manager

- Equity Manager

- Bonds Manager

- Real-Estate Manager

- Alternative (Hedge) Manager

- Mutual Funds Manager

Investment managers normally make investments for HNWI on either

- A ‘discretionary’ basis within the parameters, limits and constraints agreed with HNWI – they are very flexible, or

- An advisory or non-discretionary basis where advice is given on when to invest but the decision to invest or not rests with the client.

To learn more about Wealth services and Family Office - CLICK HERE

The Swiss Association supports professionals to join, navigate, & succeed in the blue ocean of family office and private wealth solutions.

➡️ Join the Private Wealth & Family Office (PWFO) Association Community here: CLICK HERE

➡️ Do not forget to follow us on social media to have the latest updates 😀 Link here ⬇️