Private Wealth & Family Office Association - Weekly 13 August

A little trivia around the “FAMILY OFFICE”

By Ayoob Rawat & Kabir Rawat

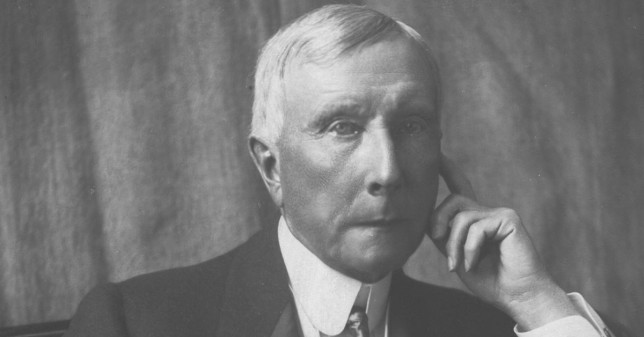

American industrialist, philanthropist, and private entrepreneur, John D. Rockefeller Sr., is often referred to as a crucial figure in the history of family offices. Co-founder of the Standard Oil Company, he controlled approximately 80% to 90% of the worldwide oil industry by the end of the 19th century.

His fortune stood at $1.4 billion at his death in 1937, accounting for more than 1.5% of the US economy. Equivalent to approximately $255 billion today, Rockefeller’s wealth is considered to be one of the greatest in history.

In 1882, Rockefeller established an office of professionals to organise his complex business operations and manage his family’s growing investment needs. This office would manage his wealth as an investment portfolio instead of singular business entities, and his assets were consolidated under the Standard Oil Trust.

This institutionalised set-up is generally considered the first modern single-family office, although it was never referred to as a ‘family office’.

A (Single) family office is a privately controlled (group of) staff employed within or outside a dedicated structure that assists a family with the organisation, management, and maintenance of all or parts of their assets, needs, and wishes with a core focus on wealth creation, protection, growth and succession planning.

The “family” define the mission of the "office" which is to ensure the family’s prosperity by collectively directing the affairs of the family while meeting the appropriate interests of each family member and respecting the interest of all stakeholders.

A strong multi-family office trend exists today, with new providers setting up offices, on an almost weekly basis, around the globe. One would think that the services offered by a multi-family office would be similar to those provided by a single-family office, with the exception being that the same services are offered to several families as opposed to only one.

Whether single or multi, such an office does not sell products but rather the expertise of a professional or a team of professionals, who aim to give objective advice to their family members.

They are paid by the families without any other form of compensation from 3rd parties or service providers.

As mentioned above, different businesses employ the ‘family office’ designation in their marketing initiatives. Banks, Asset Managers, Lawyers, Accountants, and Trust practices have departments or teams offering family office services.

➡️ SERVICES PROVIDED BY A FAMILY OFFICE - CLICK HERE

How to win in The Wealth Game

Extracts from The Wealth Game – An Ordinary Person’s Companion - By Peter Alcaraz

Every game needs a “how to win” section in the instructions. Without one, what’s the point in playing?

There is a direct relationship between how hard you pursue something and the nature of the goal. The harder you pursue, the more you will achieve. To achieve, it is therefore important to have a strong goal. And without a goal of any kind, why would you act at all?

To do so would be mindless, action by autopilot. Goals like surviving, finding a mate, and reproducing are instinctive, but in many areas, we need to create our own.

In martial arts, the objective is to physically demolish one’s opponent, either to crush or immobilize him or her. A direct approach is best, and there is no room for half-heartedness or uncertainty.

A person who wavers and hesitates moves around without clear purpose, or stays rooted to the spot will lose. To achieve the goal, one needs to train one body and mind and learn many skills. It also helps to pick the right opponent.

More everyday examples are found in dieting and eating regimes. A goal of “I want to lose weight” is weak and woolly compared with “I want to lose two stone and keep it off,” “I want to fit into a size-ten party dress for my next birthday,” or “I’m going to give up meat, go gluten-free, or food combine.”

The definition of your net worth is the total value of all your cash and assets, less any debt or other obligations for which you are liable. Other commonly used terms are net assets or balance sheet. They all mean the same.

To be most effective, a goal must be the following:

- Worthwhile

- Measurable

- Realistically believable

➡️ Where’s the Finish Line? - CLICK HERE

➡️ I can live the life I want without needing to work for money again. - CLICK HERE

🟢 Needs make up the liability side of the equation. They erode your net worth, so every pound reduction in your needs adds to your net worth. Think about this for a minute.

🟢 This article will disclose the 9 steps (or decisions) that we took to create a fiduciary multi-family office safeguarding assets of over $20 billion.

🟢 This is a measurement of your wealth at a point in time. You have a net worth right now, and the sooner you know it, the better. Whether positive or negative, large or small, solid or uncertain, it is your starting point.

Join our community to get more regular content like this 😊

➡️ click here

Thank you and stay safe.

Kind Regards,

PWFO Team

The Swiss Association supporting professionals to join, navigate & succeed in the blue ocean that is family office and private wealth solutions.

Join the Private Wealth & Family Office (PWFO) Association Community HERE 🙂

Or on socials: